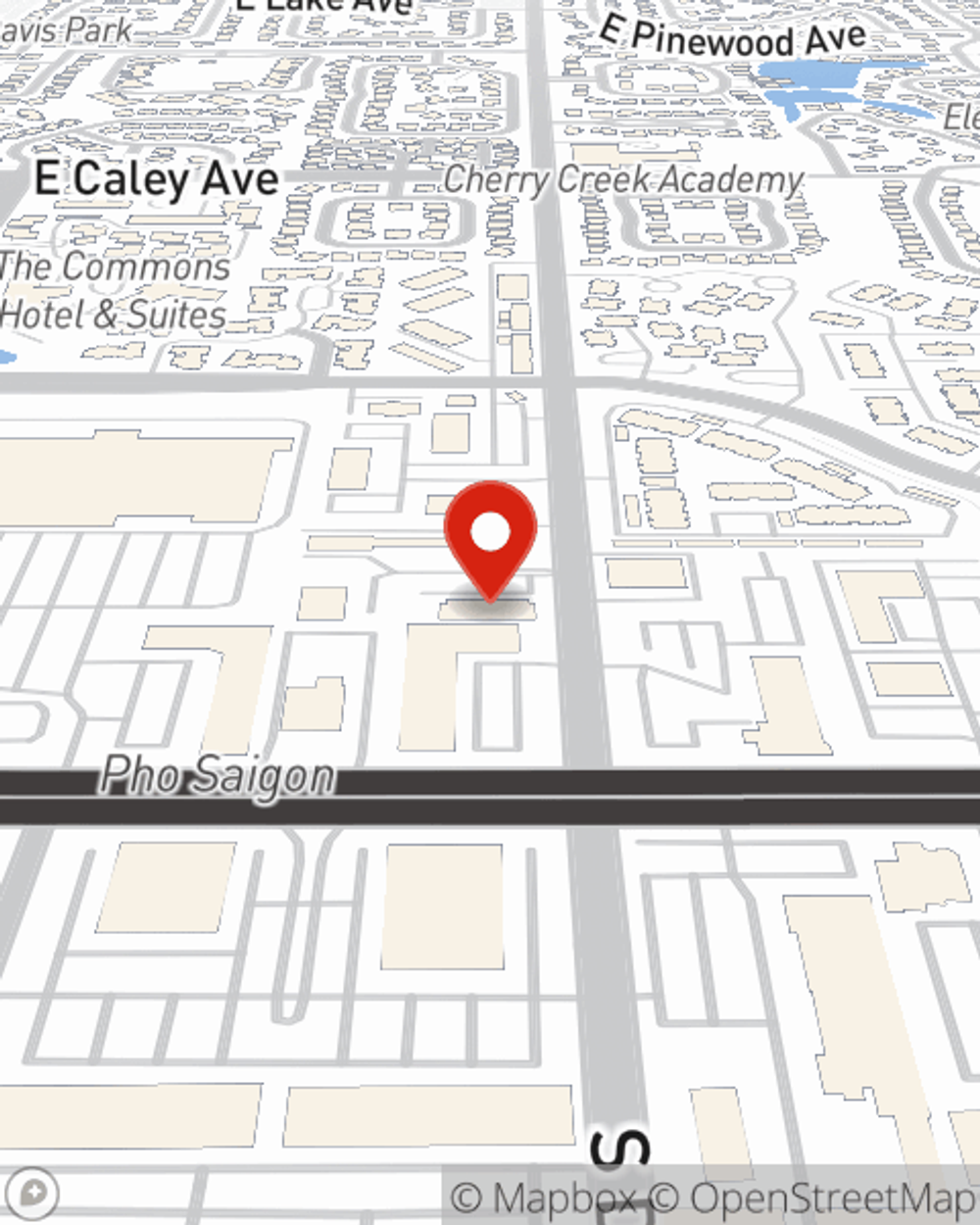

Life Insurance in and around Greenwood Village

Insurance that helps life's moments move on

What are you waiting for?

Would you like to create a personalized life quote?

- Greenwood Village

- Centennial

- Denver

- Denver Tech Center

- Highland Ranch

- Castle Rock

- Castle Pines

- Parker

- Englewood

- Pine

- Arapahoe County

- Douglas County

- Lone Tree

- Aurora

- Lakewood

- Boulder

- Evergreen

- Thornton

- Colorado Springs

- Broomfield

- Golden

- Fort Collins

- Littleton

- Arvada

Protect Those You Love Most

If you are young and newly married, it's the perfect time to talk with State Farm Agent Beth Bales about life insurance. That's because once you buy a home or condo, you'll want to be ready if the worst happens.

Insurance that helps life's moments move on

What are you waiting for?

Put Those Worries To Rest

Coverage from State Farm helps you rest easy knowing your family will be taken care of even if the worst comes to pass. Because most young families rely on dual incomes, the loss of one salary can be completely devastating. With the many expenses that come with meeting the needs of children, life insurance is absolutely essential for young families. Even for parents who stay home, the costs of replacing domestic responsibilities or housekeeping can be substantial. For those who don't have children, you may be financially responsible to business partners or have aging parents who rely on your income.

If you're a person, life insurance is for you. Agent Beth Bales would love to help you find out the variety of coverage options that State Farm offers and help you get a policy that's right for you and the ones you love most. Get in touch with Beth Bales's office to get started.

Have More Questions About Life Insurance?

Call Beth at (303) 993-2727 or visit our FAQ page.

- Build a stronger well-being.

- Get guidance and motivation to strengthen key areas of your overall wellness.

- Explore estate and end-of-life planning tools.

Simple Insights®

Reasons to buy life insurance

Reasons to buy life insurance

Life insurance is often thought of as a way to protect loved ones by providing for final expenses and estate taxes but you can think beyond that.

What is survivorship universal life insurance?

What is survivorship universal life insurance?

Survivorship universal life insurance can be used for legacy/estate planning, business transitions, charitable giving and more.

What happens when term life insurance expires?

What happens when term life insurance expires?

Understand your options before your level term life insurance policy becomes annually renewable causing your premiums to increase.

Simple Insights®

Reasons to buy life insurance

Reasons to buy life insurance

Life insurance is often thought of as a way to protect loved ones by providing for final expenses and estate taxes but you can think beyond that.

What is survivorship universal life insurance?

What is survivorship universal life insurance?

Survivorship universal life insurance can be used for legacy/estate planning, business transitions, charitable giving and more.

What happens when term life insurance expires?

What happens when term life insurance expires?

Understand your options before your level term life insurance policy becomes annually renewable causing your premiums to increase.